We use cookies to provide the best site experience.

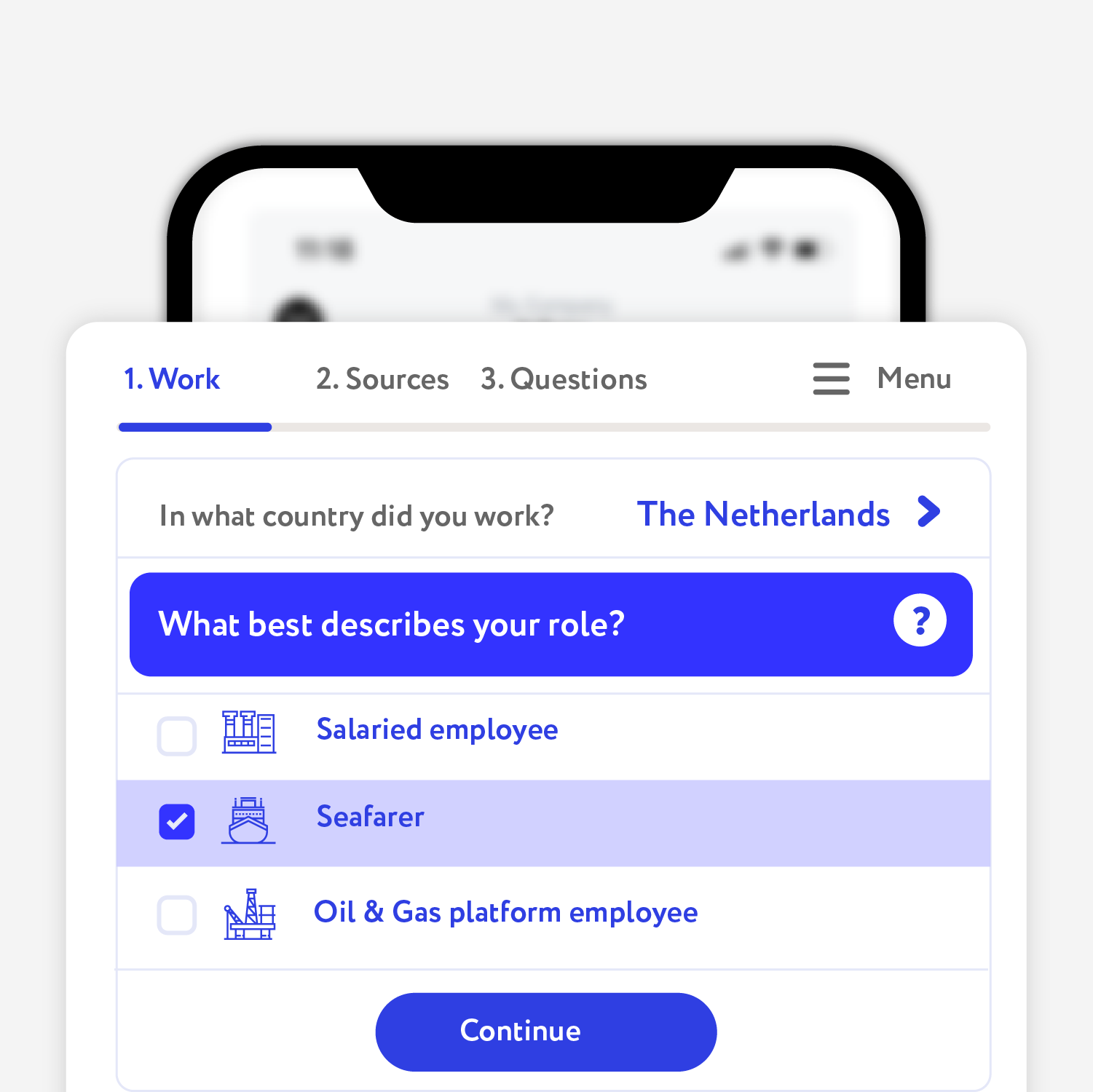

Any foreigner who works as a seafarer or performs other work at sea has the legal right to refund part of Finnish taxes or get a 100% tax refund. Don't miss out!

Yes

Can I refund Finnish taxes, if I was working at sea?

months in tax year you worked in Finland

> 6

> 2

tax credits need to request to get the tax refunds in full

Tax overpayment happens, if ...

of your yearly income was earned in Finland

> 75 %

It's worth noting that Finnish taxes can easily cut up to 35% of the salaries of the non-resident seafarers and workers at sea.

Fortunately, there are tax credits ✊✨ to pay less taxes

Some tax credits apply automatically. But to get the tax credits in full - just start with online registration and then our tax agent takes care of your Finnish taxes.

Fortunately, there are tax credits ✊✨ to pay less taxes

Some tax credits apply automatically. But to get the tax credits in full - just start with online registration and then our tax agent takes care of your Finnish taxes.

75% of income earned in Finland

In case if you worked less than 6 months, but you received more than 75% of the annual income in Finland, you are eligible to get a full amount of tax credits.

Expenses for temporary accommodation

When you are living separated from your family because of your work in Finland, you can claim a tax credit to cover your expenses (from 450 EUR per month).

Don't miss out!

tax credits in Finland

Travel expenses and temporary work.

When you have to pay for travel expenses in order to reach your temporary place of work in Finland (more than 750 euro), you are entitled to get the tax credit for your expenses.

We turn taxes

into

into

EUtaxback - is online service

with tax agents

with tax agents

To refunds taxes or ask for tax help — just start with online registration

You get safe online tax account with chat, pre-filled tax forms and tracking.

You get safe online tax account with chat, pre-filled tax forms and tracking.

1. Get Started

Let's do this

Our tax agent will answer all your questions. Makes a calculation, completes the tax forms and tax returns, etc.

Our tax agent takes care of your taxes.

Our tax agent takes care of your taxes.

2. That's it.

Well, that's it, you've got your refunds, we've got our %.

You can also get started by using whatsapp, viber or skype.

Just call or text us — we help you to register on our website and answer all your questions.

Just call or text us — we help you to register on our website and answer all your questions.

Maximum of advantages,

when is all-inclusive.

when is all-inclusive.

Fair price - all depends on

the refund amount.

the refund amount.

Standard

12,5%

Mini

59€

If the refund amount is over 473€, service fee is 12,5% of the amount

If the refund amount is between 0€ to 472€, service fee is only 59€

Service

Finland tax refunds

All prices and commissions include VAT

Price

includes:

Free calculation

Tax agent estimates your tax refund and explains the reasons of overpayment.

Tax agent estimates your tax refund and explains the reasons of overpayment.

Free advice

Our tax agent answers all your questions, at the very start.

Our tax agent answers all your questions, at the very start.

Completing tax forms and tax return

We prepare, complete and submit your tax return, tax forms.

We prepare, complete and submit your tax return, tax forms.

Communication with the tax office

We call or write to the tax office - all about your case.

We call or write to the tax office - all about your case.

About Finnish taxes and forms

Quick facts

Quick facts

Both local and foreign citizens are able to use a wide range of tax credits in Finland to reduce the overall amount of taxes (called "vähennys" in Finnish language). Kindly note that general tax credits are automatically added to the tax return. But some tax credits can help reduce the amount of taxes you pay.

1) If you pay in Finland "special tax" for non-resident (35 %), are entitled to get the full amount of tax credits available for local citizens and tax residents, if any of two conditions below match:

At the same time, you are able to get tax credits in order to cover transportation and food expenses, as well as to cover travel expenses and money spent on accommodation.

2) If you paid a special tax rate (35%) for non-resident, you can get a tax credit for income (in Finnish: lähdevero vähennys; källskatteavdrag).

If you receive this tax credit, the income tax is withheld after the non-taxable amount - 510 euros per month (or 17 euros per day). To get this tax credit, you have to make a claim.

1) If you pay in Finland "special tax" for non-resident (35 %), are entitled to get the full amount of tax credits available for local citizens and tax residents, if any of two conditions below match:

- Your salary in Finland is at least 75% of the yearly income,

- You are staying in Finland for more than 6 months.

- You are a citizen of EU/EEA country, or a citizen of country with which Finland has signed a tax treaty).

At the same time, you are able to get tax credits in order to cover transportation and food expenses, as well as to cover travel expenses and money spent on accommodation.

2) If you paid a special tax rate (35%) for non-resident, you can get a tax credit for income (in Finnish: lähdevero vähennys; källskatteavdrag).

If you receive this tax credit, the income tax is withheld after the non-taxable amount - 510 euros per month (or 17 euros per day). To get this tax credit, you have to make a claim.

What are the benefits of tax credits? Claiming tax credits save you don't pay taxes on income you've already spent as work expenses.

Because it's profitable! According to the Verohallinto in 2017 - thanks to tax credits, 3.6 million people received tax refunds in the amount of 2.9 billion euros 😀👍 🔥🔝

Almost a million people received a tax refund of more than 1,000 euros.

Most topical tax credits in Finland for individuals

1. Commuting expenses. Travel expenses and temporary work. When you have to pay for travel expenses in order to reach your temporary place of work in Finland (more than 750 euro) - you are entitled to get the tax credit for your expenses.

If you don't ride public transportation for your commute, the calculation is based on the following values:

It is beneficial, if you are married and have a child under 18 years of age, you can additionally claim an expenses of your trip to home on weekends, to see your family once a week.

2) Second home for work. When you are living separated from your family because of your work in Finland, you can can claim a tax credit, to cover your expenses - if all of the following requirements are met:

In 2019 and 2020, the maximum deduction is €450 per month. However, the deduction cannot be higher than the rent you pay for your second home.

Because it's profitable! According to the Verohallinto in 2017 - thanks to tax credits, 3.6 million people received tax refunds in the amount of 2.9 billion euros 😀👍 🔥🔝

Almost a million people received a tax refund of more than 1,000 euros.

Most topical tax credits in Finland for individuals

1. Commuting expenses. Travel expenses and temporary work. When you have to pay for travel expenses in order to reach your temporary place of work in Finland (more than 750 euro) - you are entitled to get the tax credit for your expenses.

If you don't ride public transportation for your commute, the calculation is based on the following values:

- €0.25 per km for driving your own car

- €0.19 per km for driving a company car

- €85.00 per year for riding a bicycle.

It is beneficial, if you are married and have a child under 18 years of age, you can additionally claim an expenses of your trip to home on weekends, to see your family once a week.

2) Second home for work. When you are living separated from your family because of your work in Finland, you can can claim a tax credit, to cover your expenses - if all of the following requirements are met:

- if you have a family (you child under the age of 18);

- if you have rented a second home because of the location of your primary place of work;

- if your second home is located more than 100 km from your permanent home.

In 2019 and 2020, the maximum deduction is €450 per month. However, the deduction cannot be higher than the rent you pay for your second home.

If you work in Finland or have to pay local taxes, you may visit the local tax authorities called Verohallinto to create an account in the MyTax online payment system (it's called OmaVero in Finnish).

The tax account contains summarized information about paid taxes, information from the tax-at-source card, tax returns, tax refunds, information from the employer and so on.

The tax account contains summarized information about paid taxes, information from the tax-at-source card, tax returns, tax refunds, information from the employer and so on.

Kindly note that the income rate in Finland depends on the number of working days in the country. The higher the income, the higher are taxes.

Local people (workers) and tax residents of Finland are able to pay taxes after the deduction of tax credit (from the taxable amount).

More information

Non-residents of Finland are obliged to pay the so-called 'Special income tax' from the first Euro.

It is beneficial, if getting the tax-at-source card, you are able to pay taxes only from the income of more than 510€ per month (or 17€ per day). This is a source tax deduction (or ähdeverovähennys and källskatteavdrag in Finnish).

Local people (workers) and tax residents of Finland are able to pay taxes after the deduction of tax credit (from the taxable amount).

More information

Non-residents of Finland are obliged to pay the so-called 'Special income tax' from the first Euro.

- The tax rate for non-residents is 35%.

It is beneficial, if getting the tax-at-source card, you are able to pay taxes only from the income of more than 510€ per month (or 17€ per day). This is a source tax deduction (or ähdeverovähennys and källskatteavdrag in Finnish).

We do our best to prepare and submit your tax returns (or tax forms and claims) to the tax office within 5 working days. In some countries tax return submitting is possible immediately. After communication will get started, our Tax Agent will report you the precise time.

Tax return processing time depends on the laws of the country. In common, it takes 1 to 3 months.

Sure, all the time we will check the status of the tax return and will keep you updated!

Tax return processing time depends on the laws of the country. In common, it takes 1 to 3 months.

Sure, all the time we will check the status of the tax return and will keep you updated!

- from 1 January to 31 December is a tax year in Finland.

- to 2nd April - you have to get a copy of the tax return.

- 7, 14 and 21 May - are the last dates when Verohallinto has to receive a preliminary copy of your tax return (in case of any changes). The deadline will be indicated in the tax return. You may receive a fine of 50€ for the late submission of the required changes to the tax statement.

- 6 August to 5 November - You will receive the decision of tax authority

💡 By the way

You are able to make changes to the tax return within three years (starting from 2017). For the period of 2012-2016, you are able to do the same within five years.

Example no. 2: Information about required changes to the tax statement for 2017 have to be submitted before December 31, 2020.

People paying taxes according to the progressive rate will receive the tax return (called Esitäytetty veroilmoitus in Finnish). The tax return form is sent by mail from March to April. You need to check the address provided to the tax authority in case you didn't receive the tax return.

Check the correctness of the information provided in the tax return form

You will see several cells with the amounts in the tax return form. It contains information about the income, taxes and tax credits for the previous year.

In case if everything is correct, you don't need to do anything and the final tax return will be the same.

In case if you need to make any changes, you have to return the form to the tax authority before the date indicated on the top of the first page (Viimeinen palautuspaiva). In general, it's May 7, 14 or 21. You will receive the calculation of taxes in a couple of months.

What is included in the Verotuspäätös?

You will receive the tax calculation together with the tax return (it's called "Verotuspäätös" or "Beskattningsbeslut").

On the first page, you can find information about tax credits or unpaid taxes:

Check the correctness of the information provided in the tax return form

You will see several cells with the amounts in the tax return form. It contains information about the income, taxes and tax credits for the previous year.

- Compare the amount of income in the form with the real income from your employer (section 1.1).

- Check the amount of taxes (section 2.1).

In case if everything is correct, you don't need to do anything and the final tax return will be the same.

In case if you need to make any changes, you have to return the form to the tax authority before the date indicated on the top of the first page (Viimeinen palautuspaiva). In general, it's May 7, 14 or 21. You will receive the calculation of taxes in a couple of months.

What is included in the Verotuspäätös?

You will receive the tax calculation together with the tax return (it's called "Verotuspäätös" or "Beskattningsbeslut").

On the first page, you can find information about tax credits or unpaid taxes:

- You will see the following word if you have to get tax credits: VERONPALAUTUS.

- In case if you have unpaid taxes, you will see the following: JÄÄNNÖSVERO.

In order to identify taxpayers in Finland, one needs to obtain the Personal identity number or Henkilötunnus (HETU).

Starting from 2012, foreign citizens working in the field of construction are assigned with an individual identity number (called Veronumeron in Finnish).

- The number consists of 10 symbols, for example, 251276-123A, where the first six symbols are the date of birth added with three more digits and 1 letter.

Starting from 2012, foreign citizens working in the field of construction are assigned with an individual identity number (called Veronumeron in Finnish).

- The number consists of 10 symbols, for example, 251276-123A, where the first six symbols are the date of birth added with four more digits.

Thank you so much for your help, success and prosperity.

03.09.2018

Edgars

Thank you for your help! I hope that we will continue to cooperate.

04.06.2018

Aleksandr

View all reviews

New feedback about EUtaxback

Taxes from: Finland

Taxes from:Finland