We use cookies to provide the best site experience.

Any foreigner working in Norway has the right to get money from the State - to refund overpaid taxes.

Don't miss out!

Don't miss out!

Yes

Can I refund

taxes paid in Norway?

months in tax year you worked in Norway

> 6

> 5

tax credits need to request to get the tax refunds in full

Tax overpayment happens, if ...

of your yearly income was earned in Norway

> 90 %

Taxes in Norway cut up to 45% of the salary.

Fortunately, there are tax credits ✊✨ to pay less taxes

Some tax credits apply automatically. But to get the tax credits in full - just start with online registration and then our tax agent takes care of your Norway taxes.

Fortunately, there are tax credits ✊✨ to pay less taxes

Some tax credits apply automatically. But to get the tax credits in full - just start with online registration and then our tax agent takes care of your Norway taxes.

3.3.7 Standardfradraget

The standard tax credit is intended for foreign workers (non-residents). It has a rate of 10% from the income, but can't be higher than 40,000 NOK.

3.2.7. Merkostnader

When you don't live home because of the work in Norway, you are able to get tax credits for accommodation and food expenses (205 NOK per day).

Don't miss out!

Norway tax credits

3.2.9. Fradrag for reisekostnader

When you have to pay for travel expenses in order to reach your temporary place of work in NO, you are entitled to get the tax credit for expenses (max. 97,000 NOK).

We turn taxes

into

into

EUtaxback - is online service

with tax agents

with tax agents

To refunds taxes or ask for tax help — just start with online registration

You get safe online tax account with chat, pre-filled tax forms and tracking.

You get safe online tax account with chat, pre-filled tax forms and tracking.

1. Get Started

Let's do this

Our tax agent will answer all your questions. Makes a calculation, completes the tax forms and tax returns, etc.

Our tax agent takes care of your taxes.

Our tax agent takes care of your taxes.

2. That's it.

Well, that's it, you've got your refunds, we've got our %.

You can also get started by using whatsapp, viber or skype.

Just call or text us — we help you to register on our website and answer all your questions.

Just call or text us — we help you to register on our website and answer all your questions.

Maximum of advantages,

when is all-inclusive.

when is all-inclusive.

Just pay a flat fee, no stress how complex your Norwegian taxes are.

Standard

185€

Mini

59€

filing a personal tax return, or change a tax return

one-time help to register bank accounts,

change registration address and others forms

change registration address and others forms

Service

Norway tax refunds

All prices and commissions include VAT

Price

includes:

Free calculation

Tax agent estimates your tax refund and explains the reasons of overpayment.

Tax agent estimates your tax refund and explains the reasons of overpayment.

Free advice

Our tax agent answers all your questions, at the very start.

Our tax agent answers all your questions, at the very start.

Completing tax forms

We prepare, complete and submit your tax forms.

We prepare, complete and submit your tax forms.

Communication with the tax office

We call or write to the tax office - all about your case.

We call or write to the tax office - all about your case.

About Norway taxes and forms

Quick facts

Quick facts

The Skatteetaten tax authority creates a personal tax account for all people obliged to pay taxes in Norway. It can be accessed via the Altinn e-government web-portal. The tax account contains summarized information about paid taxes, tax returns, tax refunds, information from the employer and so on.

Tax residents of Norway are obliged to pay the personal tax (in 2019). However, the rate depends on the amount of income and the number of tax credits.

There are several special taxes. Here's a couple of them:

- Payroll tax - 46,4%

There are several special taxes. Here's a couple of them:

- the income tax for artists is 15%.

- Bracket tax that has to be paid to the state was replaced at the beginning of 2016.

- Wealth tax - depends on the net amount of your assets.

We do our best to prepare and submit your tax returns (or tax forms and claims) to the tax office within 5 working days. In some countries tax return submitting is possible immediately. After communication will get started, our Tax Agent will report you the precise time.

Tax return processing time depends on the laws of the country. In common, it takes 1 to 3 months.

Sure, all the time we will check the status of the tax return and will keep you updated!

Tax return processing time depends on the laws of the country. In common, it takes 1 to 3 months.

Sure, all the time we will check the status of the tax return and will keep you updated!

- from January 1 to December 31 is a tax year in Norway.

- from February 15, the "Annual Statement" is available, information from which will appear in the tax return.

- from April 4-the annual tax return is available for filling in online and will also be sent by mail.

- the deadline for submitting your electronic tax return is April 30, but if you receive new information or find that something is missing from the Declaration or is faulty, you can make a change after this date.

- until may 31 — the deadline to fill out and submit a "mandatory" tax return for the previous year (for example, for the self-employed)

- June 20 - the first batch of Tax assessment (Skatteoppgjøre) will be ready. If you have not received a tax assessment (Skatteoppgjøret) on June 20, you will receive a tax notice in the second batch from August 15 to October 23.

💡 By the way

One is able to adjust the information in the tax return in three years after the deadline (May 31).

Here's an example: For the tax statement for 2017, the last day of tax return submission on May 31, 2021.

Each person who earns the salary, pension or allowance, will get a copy of the tax return RF-1030 (called selvangivelsen).

The last page of the tax return contains the Preliminary calculation of tax and duties (called Foreløpig beregning av skatter og avgifter).

The preliminary calculation contains the following information:

Check the correctness of the information.

Final tax assessment (in Norwegian: Skatteoppgjøret)

If you have made changes or left the declaration unchanged, the tax office will make the final tax assessment Skatteoppgjøret. You will receive the assessment on June 20 or from August 15 to October 23. The tax office cannot tell the exact time.

You can receive these documents by mail or in your Altinn profile.

Tax payments if tax refund and tax collection, if underpayment of taxes is carried out through the office of the tax collector. For payments and fees, contact directly by phone or mail.

Learn more at the Skatteetaten International Tax Collection Office

The last page of the tax return contains the Preliminary calculation of tax and duties (called Foreløpig beregning av skatter og avgifter).

The preliminary calculation contains the following information:

- The row called: "Foreløpig beregnet skatt og avgift etter skattefradrag" indicates the amount of taxes to be paid.

- The row called: "Foreløpig beregnet skatt til gode (uten renter)" indicates the amount of taxes to be refunded.

- The row called: "Foreløpig beregnet restskatt (uten renter)" indicates the amount of unpaid taxes.

Check the correctness of the information.

- Compare the amount of income in the form with the real income from your employer (section 2.1).

- Check the amount of tax deductions (section 3.2).

Final tax assessment (in Norwegian: Skatteoppgjøret)

If you have made changes or left the declaration unchanged, the tax office will make the final tax assessment Skatteoppgjøret. You will receive the assessment on June 20 or from August 15 to October 23. The tax office cannot tell the exact time.

You can receive these documents by mail or in your Altinn profile.

Tax payments if tax refund and tax collection, if underpayment of taxes is carried out through the office of the tax collector. For payments and fees, contact directly by phone or mail.

Learn more at the Skatteetaten International Tax Collection Office

1. Minimum tax credit (section 3.2.1 Minstefradrag). Citizens of Norway get the full amount of the tax credit, while the tax credit for foreign workers depends on the term of employment (months of work divided by 12).

The maximum amount is 97,610 NOK in 2018.

The tax authority will indicate the exact amount in the tax return; however, you need to make changes if the employment term is indicated in the wrong way.

2. If you received 90% of your income in Norway and you are a citizen of EU/EEA without being a tax resident in Norway , you are able to get the full amount of the minimum standard tax credit and the personal allowance.

3. The standard tax credit (3.3.7: Standardfradrag for utenlandske arbeidstakere).

The tax credit is intended to be used by foreign people and non-residents in Norway, as well as residents during the first 2 years. Kindly note that you are not allowed to use the standard tax credit with order tax credits, except the minimum tax credit.

The exact amount of the tax credit is 10% of the income indicated in section 2.1. of the tax return (max. 40,000 NOK in 2017). Important information: You are not allowed to use the standard tax credit with order tax credits, except the minimum tax credit.

The standard deduction cannot be combined with deduction for actual expenses.

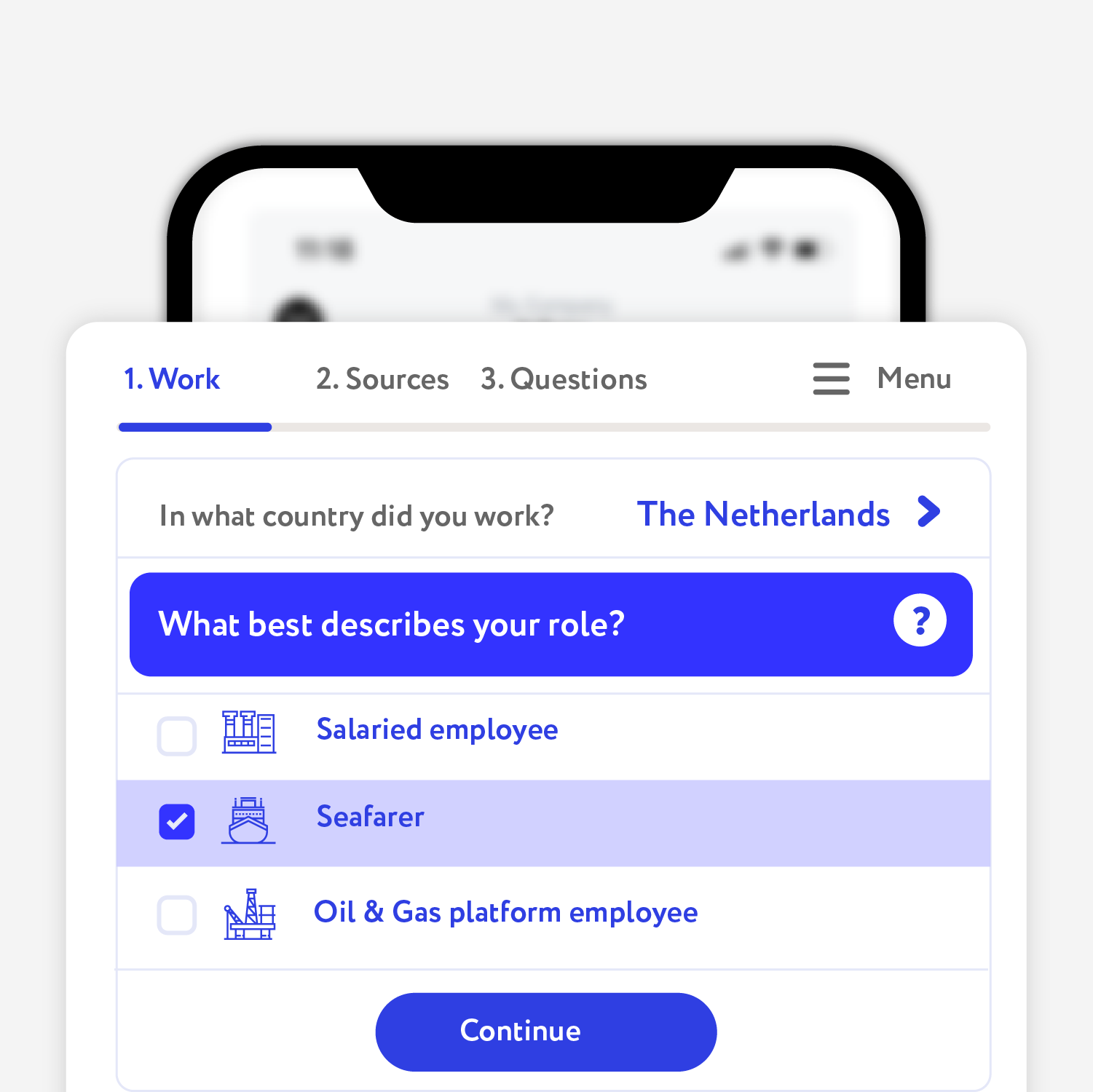

For the income year 2019 and following income years the standard deduction can only be claimed by seafarers and continental shelf workers who are residents abroad, can claim the standard deduction.

Seafarers shall have the standard deduction. Continental shelf workers can choose between the standard deduction and deduction for actual expenses.

The maximum amount is 97,610 NOK in 2018.

The tax authority will indicate the exact amount in the tax return; however, you need to make changes if the employment term is indicated in the wrong way.

2. If you received 90% of your income in Norway and you are a citizen of EU/EEA without being a tax resident in Norway , you are able to get the full amount of the minimum standard tax credit and the personal allowance.

3. The standard tax credit (3.3.7: Standardfradrag for utenlandske arbeidstakere).

The tax credit is intended to be used by foreign people and non-residents in Norway, as well as residents during the first 2 years. Kindly note that you are not allowed to use the standard tax credit with order tax credits, except the minimum tax credit.

The exact amount of the tax credit is 10% of the income indicated in section 2.1. of the tax return (max. 40,000 NOK in 2017). Important information: You are not allowed to use the standard tax credit with order tax credits, except the minimum tax credit.

The standard deduction cannot be combined with deduction for actual expenses.

For the income year 2019 and following income years the standard deduction can only be claimed by seafarers and continental shelf workers who are residents abroad, can claim the standard deduction.

Seafarers shall have the standard deduction. Continental shelf workers can choose between the standard deduction and deduction for actual expenses.

According to the EEA agreement, citizens of the EU and EEA working in Norway have the same rights as the local citizens.

In case if you have to live in a different place due to work in Norway, you can get the "commuter status" (called pendler; for families: familie pendler; for single workers: enslig pendler).

The "commuter status" employee gives you access to several tax credits at once.

Important! Starting from January 1, 2018

In case if you have to live in a different place due to work in Norway, you can get the "commuter status" (called pendler; for families: familie pendler; for single workers: enslig pendler).

The "commuter status" employee gives you access to several tax credits at once.

- Tax credit for food (section 3.2.7). You have a right to get a tax credit to cover expenses for food and accommodation.

- Expenses related to transportation between your home and work (section 3.2.8). You are entitled to a tax credit in the amount from 22,000 to 97,000 NOK.

- Expenses related to transportation to visit your home (section 3.2.9). You are entitled to a tax credit in the amount from 22,000 to 97,000 NOK.

Important! Starting from January 1, 2018

- You are not able to get the mentioned tax credit if your accommodation was equipped with cooking facilities.

- Accommodation without cooking facilities: 159 NOK per day.

- Hotel with breakfast: 455 NOK per day.

- A hotel without breakfast: 569 NOK per day.

- The suburban status is given for the first 2 years.

Sailors, offshore workers, oil and gas sector employees are entitled to get a special tax credit (called særskilt fradrag или fiskere og fangstfolk) in addition to all tax credits and refunds available for the people working in the mainland.

If you spent more than 130 days in the sea, you are able to get a discount of 30% of the income, but not higher than 150,000 NOK.

If you spent more than 130 days in the sea, you are able to get a discount of 30% of the income, but not higher than 150,000 NOK.

According to the EEA agreement, citizens of the EU and EEA working in Norway have the legal right to get a tax credit to cover the interest rate of loans (mortgage, consumer loans, credit cards and so on) in the country of their permanent residence.

Important information:

You have to receive at least 90% of the annual income in Norway. You are not able to combine the standard tax deduction (10%) with the tax credit intended to cover the interest rates.

Important information:

You have to receive at least 90% of the annual income in Norway. You are not able to combine the standard tax deduction (10%) with the tax credit intended to cover the interest rates.

All single taxpayers are considered the representatives of the first tax class. If you are married and your spouse earned less than 44,751 NOK (in 2017), you should think about switching to skatteklasse 2.

The amount of nontaxable personal allowance

Class 1 NOK 53,150

Class 2 NOK 78,300

Important information:

The second class was eliminated on January 1, 2018.

The amount of nontaxable personal allowance

Class 1 NOK 53,150

Class 2 NOK 78,300

Important information:

The second class was eliminated on January 1, 2018.

As soon as the tax office processes your tax return, you will receive a notification about tax assessment notice (called skatteoppgjør).

The tax assessment will be sent in June or October.

You will get a refund in case if you overpaid taxes.

Appealing

In case if you want to change the tax assessment, you need to submit an appeal request in six weeks after receiving the tax assessment.

Your appeal request has to contain detailed information about the mistake.

You are also able to submit the same request even after 6 weeks.

At the same time, you are still able to adjust tax assessment even after the deadline. However, the tax authority of Norway reserves the right to reject your request. At the same time, there are almost no cases of rejection, so you are free to adjust the information whenever you want.

The tax assessment will be sent in June or October.

You will get a refund in case if you overpaid taxes.

Appealing

In case if you want to change the tax assessment, you need to submit an appeal request in six weeks after receiving the tax assessment.

Your appeal request has to contain detailed information about the mistake.

You are also able to submit the same request even after 6 weeks.

At the same time, you are still able to adjust tax assessment even after the deadline. However, the tax authority of Norway reserves the right to reject your request. At the same time, there are almost no cases of rejection, so you are free to adjust the information whenever you want.

In order to identify people in Norway, local authorities issue special identification numbers. There are two types of personal numbers: D number (called d-nummer) and the national identification number (called fødselsnummer).

If you have the D number, but you decide to get a national identification number, you have to use the national identification number only.

- The D number consists of 11 digits.

- The national identification number consists of 11 digits, while the first 6 digits represent the date of birth.

If you have the D number, but you decide to get a national identification number, you have to use the national identification number only.

If you received a cheque from Skatteetaten and you are not able to get your money, or you were just too late to make it, we are here to help you.

Thank you for your help, and may your company continue to be lucky

14.06.2018

Maksims

Thank you for your help! I hope that we will continue to cooperate

04.08.2018

Vadims

View all reviews

New feedback about EUtaxback

Taxes from: Norway

Taxes from: Norway