We use cookies to provide the best site experience.

Any foreigner who works as a seafarer or performs other work at sea has the legal right to refund part of Dutch taxes or get a 100% tax refund. Don't miss out!

Yes

Can I refund Dutch taxes, when I was working at sea?

years old (including) of you dependent child

< 12

2, 3,

employers you had during one tax year

Tax overpayment happens, if ...

foreign port outside the Dutch territorial waters

> 1

Dutch taxes take up to 52% of the salary of the seafarers working on a vessel.

Fortunately, there are tax credits ✊✨ to pay less taxes

Some tax credits apply automatically. But to get the tax credits in full - just start with online registration and then our tax agent takes care of your Dutch taxes.

Fortunately, there are tax credits ✊✨ to pay less taxes

Some tax credits apply automatically. But to get the tax credits in full - just start with online registration and then our tax agent takes care of your Dutch taxes.

The amount depends on your working period. If you worked for 12 months in the Netherlands — the amount of tax credit will be the maximum €2711 (in 2020).

The employed person's tax credit partially applies in the salary. The amount depends on your age, income and working period the maximum €3819 (in 2020).

Don't miss out!

Dutch tax credits

The income-related combination tax credit - if you have a dependent child under 12 years old (including). The amount depends on your income the maximum € 2881 (in 2020)

We turn taxes

into

into

EUtaxback - is online service

with tax agents

with tax agents

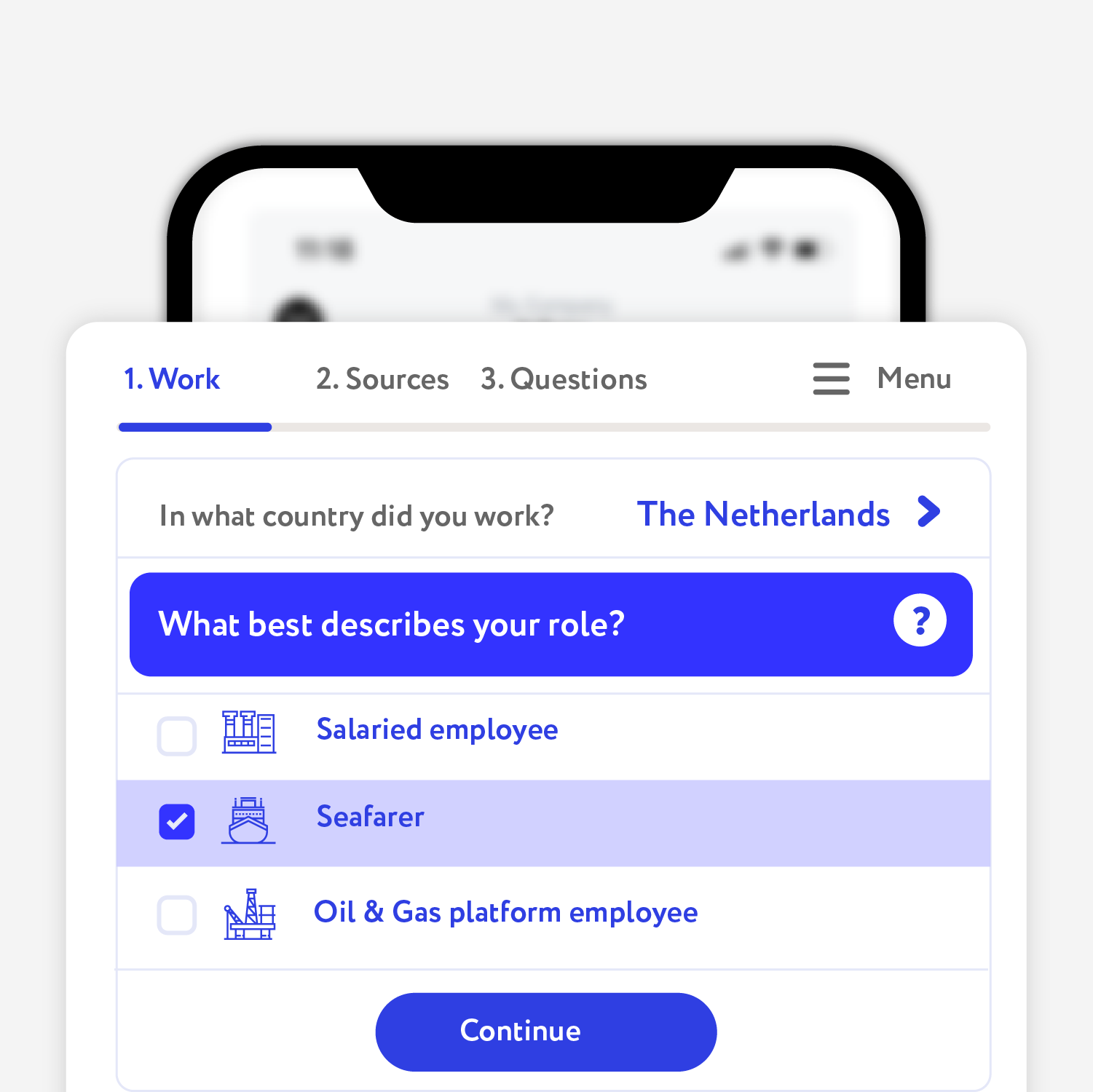

To refunds taxes or ask for tax help — get starting with online registration

You get safe online tax account with chat, pre-filled tax forms and tracking.

You get safe online tax account with chat, pre-filled tax forms and tracking.

1. Get Started

Let's do this

Our tax agent will answer all your questions. Makes a calculation, completes the tax forms and tax returns, etc.

Our tax agent takes care of your taxes.

Our tax agent takes care of your taxes.

2. That's it.

Well, that's it, you've got your refunds, we've got our %.

You can also get started by using whatsapp, viber or skype.

Just call or text us — we help you to register on our website and answer all your questions.

Just call or text us — we help you to register on our website and answer all your questions.

No risk, you can start without any prepayment.

Pay for the service only if there is a tax refund.

Pay for the service only if there is a tax refund.

Fair price - all depends on

the refund amount.

the refund amount.

Standard

12,5%

Mini

59€

If the refund amount is over 473€, service fee is 12,5% of the amount

If the refund amount is between 0€ to 472€, service fee is only 59€

Service

Tax refunds from the Netherlands

All prices and commissions include VAT

Price

includes:

Free calculation

Tax agent estimates your tax refund and explains the reasons of overpayment.

Tax agent estimates your tax refund and explains the reasons of overpayment.

Free advice

Our tax agent answers all your questions, at the very start.

Our tax agent answers all your questions, at the very start.

Completing tax forms and tax return

We prepare, complete and submit your tax return, tax forms.

We prepare, complete and submit your tax return, tax forms.

Communication with the tax office

We call or write to the tax office - all about your case.

We call or write to the tax office - all about your case.

About Dutch taxes and forms

Quick facts

Quick facts

All Dutch employees pay to the government: income tax (in Dutch: Inkomstenbelasting box 1), and social insurance and pension contributions (in Dutch: «Volksverzekeringen»). Fortunately, foreign workers have the right to claim tax credits 😉

Dutch tax rates

Salary taxes depend on the income and the retirement age, the greater the income, the higher the percentage of tax levied. Income tax rate in 2018 is starting from 36.55% should the income be up to € 20.142, and maximum 51,95% should the income be up to €68,507.

Dutch taxes rates (for individuals) you can find on the website Belastingdienst choosing the year.

Dutch tax rates

Salary taxes depend on the income and the retirement age, the greater the income, the higher the percentage of tax levied. Income tax rate in 2018 is starting from 36.55% should the income be up to € 20.142, and maximum 51,95% should the income be up to €68,507.

Dutch taxes rates (for individuals) you can find on the website Belastingdienst choosing the year.

Dutch residents and foreign workers are eligible to claim a general tax credit (in Dutch: algemene heffingskorting). The general tax credit depends on your income, your age and your working period in the Netherlands during the tax year. It will decrease your payroll taxes.

More info about the general tax credit (algemene heffingskorting) rates you can find on the Belastingdienst website:

Calculation sample

You have worked in the Netherlands for 6 months in 2020 and your income was 20.000 €, you leave not in the Netherlands and 90% of your income was earned in the Netherlands

You are entitled to receive a general tax credit for 6 months (30x6=180) The maximal possible tax credit amount for a year is € 2711. As a result you can get 180/360 x € 2711 = € 1355

More info about the general tax credit (algemene heffingskorting) rates you can find on the Belastingdienst website:

Calculation sample

You have worked in the Netherlands for 6 months in 2020 and your income was 20.000 €, you leave not in the Netherlands and 90% of your income was earned in the Netherlands

You are entitled to receive a general tax credit for 6 months (30x6=180) The maximal possible tax credit amount for a year is € 2711. As a result you can get 180/360 x € 2711 = € 1355

You get the employed person's tax credit (in Dutch: Arbeidskorting) when you work in Holland. Your employer partially takes this tax credit into account when calculating your salary.

The employed person's tax credit depends on your income, your age and working period in the Netherlands during a tax year. The amount of the employed person's tax credit will reduce your amount of payroll.

The employed person's tax credit Arbeidskorting is shown in the annual income statement Jaaropgaaf. If the amount will be less than expected, after you file your tax return, you receive the refund.

Below you will find a table with the maximum amounts of the employed person's tax credit rates, or more on the website Belastingdienst:

The employed person's tax credit depends on your income, your age and working period in the Netherlands during a tax year. The amount of the employed person's tax credit will reduce your amount of payroll.

The employed person's tax credit Arbeidskorting is shown in the annual income statement Jaaropgaaf. If the amount will be less than expected, after you file your tax return, you receive the refund.

Below you will find a table with the maximum amounts of the employed person's tax credit rates, or more on the website Belastingdienst:

You can claim tax credit "Combination tax credit" (in Dutch - InInkomensafhankelijke combinatiekorting) if:

💡Important to know

A combined tax credit won't appear automatically on your payslip - you can only get your money if you file a tax return.

Below you will find a table with the maximum amounts of the combined tax credit rates or more information on the website Belastingdienst:

Combined tax credit depends on your income and the working period in the Netherlands during the tax year. It reduces your income tax.

If your income in 2020 is above €5072 (fixed sum) - you can claim a combined tax credit. Maximum amount in 2020 is € 2881.

- You have a dependent child under 12 years old, included (your child or a child of your tax partner);

- The child has been registered at your home address not less than 6 months in one calendar year;

- Your salary is higher than "fixed sum"

💡Important to know

A combined tax credit won't appear automatically on your payslip - you can only get your money if you file a tax return.

Below you will find a table with the maximum amounts of the combined tax credit rates or more information on the website Belastingdienst:

Combined tax credit depends on your income and the working period in the Netherlands during the tax year. It reduces your income tax.

If your income in 2020 is above €5072 (fixed sum) - you can claim a combined tax credit. Maximum amount in 2020 is € 2881.

We do our best to prepare and submit your tax returns to the tax office within 5 working days. In some countries tax return submitting is possible immediately. After communication will get started, our Tax Agent will report you the precise time.

Tax return processing time depends on the laws of the country. In common, it takes 2 to 3 months. In some exceptional cases, the maximum term is up to 3 years. Sure, all the time we will check the status of the tax return and will keep you updated!

Important dates

💡 Last chance:

Till 31.01.2022 - You have the last chance to file a tax return for 2016

Tax return processing time depends on the laws of the country. In common, it takes 2 to 3 months. In some exceptional cases, the maximum term is up to 3 years. Sure, all the time we will check the status of the tax return and will keep you updated!

Important dates

- 5 years - you can apply for a tax refund in the Netherlands only for the last 5 years.from 1st January till 31st December - Tax year in the Netherlands

- from 1st March - yearly tax return is available for submitting.

- till 1st April - if you submit your tax return for the previous year till the 1st of April, the tax office promises to send you an assessment and refund money till the 1st of July.

- till 1st May - is necessary to submit the "mandatory" tax return for the previous year, but the term can be extended.

- till 1st June - the term to submit "mandatory" tax return (M-form) for the previous tax year, if you arrived and left the country (means you registered and deregistered your Dutch address at the municipality (in Dutch: Stadhuis)

💡 Last chance:

Till 31.01.2022 - You have the last chance to file a tax return for 2016

Voluntary tax return:

Mandatory tax return

If you are a Dutch tax resident, you have to file a tax return if:

- If you are a Non-Dutch tax resident, you do not have to file the Dutch tax return if the following cases: if your income was only from salary; you have not registered your Dutch address at the NL municipality; you do not have any tax debt; you have not received an invitation from the tax office (Belastingdienst) to file a tax return;

- If you want to receive the full amount of tax credits.

Mandatory tax return

If you are a Dutch tax resident, you have to file a tax return if:

- you want to get a tax refund;

- if you have received an invitation from the tax office (Belastingdienst) to file a tax return;

- if your income in the Netherlands was over 45€ and no tax was deducted from it;

- if you arrived and left the country (means you registered and deregistered your Dutch address at the municipality (in Dutch: Stadhuis).

Annual statement (in Dutch Jaaropgaaf or sometimes "Jaaropgave") is an important document to keep for your own records, besides is needed to submit your tax return.

Your employer has to issue to you an annual certificate about your pay and withheld taxes after the tax year is over - usually, you get it in January of February.

In the statement Jaaropgaaf there is the following information provided:

You can see an example of the Jaaropgaaf on the website of Belastingdienst under:Jaaropgaaf

Your employer has to issue to you an annual certificate about your pay and withheld taxes after the tax year is over - usually, you get it in January of February.

In the statement Jaaropgaaf there is the following information provided:

- earned income (Loon loonbelasting / Volksverzekeringen);

- paid taxes (income and social tax) - (Loonbelasting Ingehouden / Premie volksverzekeringen);

- employed person's tax credit (Verrekende arbeidskorting) that you have received from your employer.

You can see an example of the Jaaropgaaf on the website of Belastingdienst under:Jaaropgaaf

A provisional assessment (in Dutch: Voorlopige aanslag) - is a calculation made by the tax office containing the information about tax assessment for one tax year. You will receive this assessment after your tax return was submitted and you are expecting to receive a tax refund. Generally, the tax office promises to send you a provisional assessment within 12 weeks upon receipt of your application or a tax return.

An assessment is being sent to your home address saved in the system of the tax office at the day the assessment has been issued. Postal delivery usually takes 2 to 3 weeks.

On the 1st page of the assessment is indicated the amount of overpaid or underpaid tax. On the 2nd page of the assessment is shown your income from salaries, pensions, benefits, savings and interest, deducted tax, non-taxable minimum and other tax deductions and al calculation result.

A final assessment (in Dutch: - Definitieve aanslag) usually is the same as a provisional assessment.Sometimes, you receive a provisional assessment first and after the final assessment.

If there was a tax overpayment in your provisional assessment, after the payment has been made, the tax office will send you a final assessment with a result "0".

You receive a final statement not later than within 3 years. This period begins on the 1st of January after the reporting year. Usually it does not take so long.

Example

If you have filled your tax return 2018 before 1st May 2019 - you have to get a final tax assessment not later than 31st December 2021.

An assessment is being sent to your home address saved in the system of the tax office at the day the assessment has been issued. Postal delivery usually takes 2 to 3 weeks.

On the 1st page of the assessment is indicated the amount of overpaid or underpaid tax. On the 2nd page of the assessment is shown your income from salaries, pensions, benefits, savings and interest, deducted tax, non-taxable minimum and other tax deductions and al calculation result.

A final assessment (in Dutch: - Definitieve aanslag) usually is the same as a provisional assessment.Sometimes, you receive a provisional assessment first and after the final assessment.

If there was a tax overpayment in your provisional assessment, after the payment has been made, the tax office will send you a final assessment with a result "0".

You receive a final statement not later than within 3 years. This period begins on the 1st of January after the reporting year. Usually it does not take so long.

Example

If you have filled your tax return 2018 before 1st May 2019 - you have to get a final tax assessment not later than 31st December 2021.

National Insurance Number (in Dutch: Burgerservicenummer (BSN) or sofinummer) - is a unique registration number for every person who lives or works in the Netherlands.

BSN number consists of 9 numbers:

444.22.333

You can find your BSN number:

BSN number consists of 9 numbers:

444.22.333

You can find your BSN number:

- on the payslip;

- on the form Jaaropgaaf;

- on any letter received from the tax office.

Tax partner (in Dutch: fiscale partner) helps you to claim more legal tax credits and increase your tax refund amount.

Who may be considered as your tax partner?

Example

You have worked for 12 months in the Netherlands (90% of your yearly income earned in the Netherlands).

You are entitled to claim the maximum amount of tax credits for 12 months:

If your tax partner had no income or partner's income was small but your yearly income was earned in the Netherlands, your tax partner can also claim the general tax credit in whole (the maximum amount).

Who may be considered as your tax partner?

- Your are married;

- You are not married but you are registered at the same address and you meet the following conditions:

- You have a child together;

- Your partner's child is registered as your dependent child;

- You own a home together;

- You were already tax partners the year before.

Example

You have worked for 12 months in the Netherlands (90% of your yearly income earned in the Netherlands).

You are entitled to claim the maximum amount of tax credits for 12 months:

- general tax credit;

- employed person's tax credit.

If your tax partner had no income or partner's income was small but your yearly income was earned in the Netherlands, your tax partner can also claim the general tax credit in whole (the maximum amount).

I would like to thank you for your help in returning taxes from the Netherlands. I have received a tax refund in full today. Have recommended you to my friends

26.05.2018

Mark

Thank you very much. Money have reached my bank account. I am fully satisfied with the work of your company. Definitely will come back to you again.

02.06.2018

Ron

View all reviews

New feedback about EUtaxback

Taxes from: the Netherlands

Taxes from: the Netherlands