We use cookies to provide the best site experience.

Any foreigner working in United Kingdom has the right to get money from the State - to refund overpaid taxes.

Don't miss out!

Don't miss out!

Yes

Can I refund

taxes paid in the United Kingdom?

months in tax year you worked in the UK

< 12

> 60 £

of work-related expenses paid by you

Tax overpayment happens, if ...

employers you had during one tax year

2, 3,

UK taxes take up to 45% of the salary.

Fortunately, there are tax credits ✊✨ to pay less taxes

Some tax credits apply automatically. But to get the tax credits in full - just start with online registration and then our tax agent takes care of your UK taxes.

Fortunately, there are tax credits ✊✨ to pay less taxes

Some tax credits apply automatically. But to get the tax credits in full - just start with online registration and then our tax agent takes care of your UK taxes.

1. Personal Allowance

Personal allowance is the amount of income you don't pay your tax on. In tax year 2018-19 income up to £11,850 is tax free.

2. Job expenses

Tax credit is obtainable, if you spend your money (more than £60) on work-related expenses such as uniform, laundry services, equipment repair services.

Don't miss out!

tax credits in the United Kingdom

We turn taxes

into

into

EUtaxback - is online service

with tax agents

with tax agents

To refunds taxes or ask for tax help — get starting with online registration

You get safe online tax account with chat, pre-filled tax forms and tracking.

You get safe online tax account with chat, pre-filled tax forms and tracking.

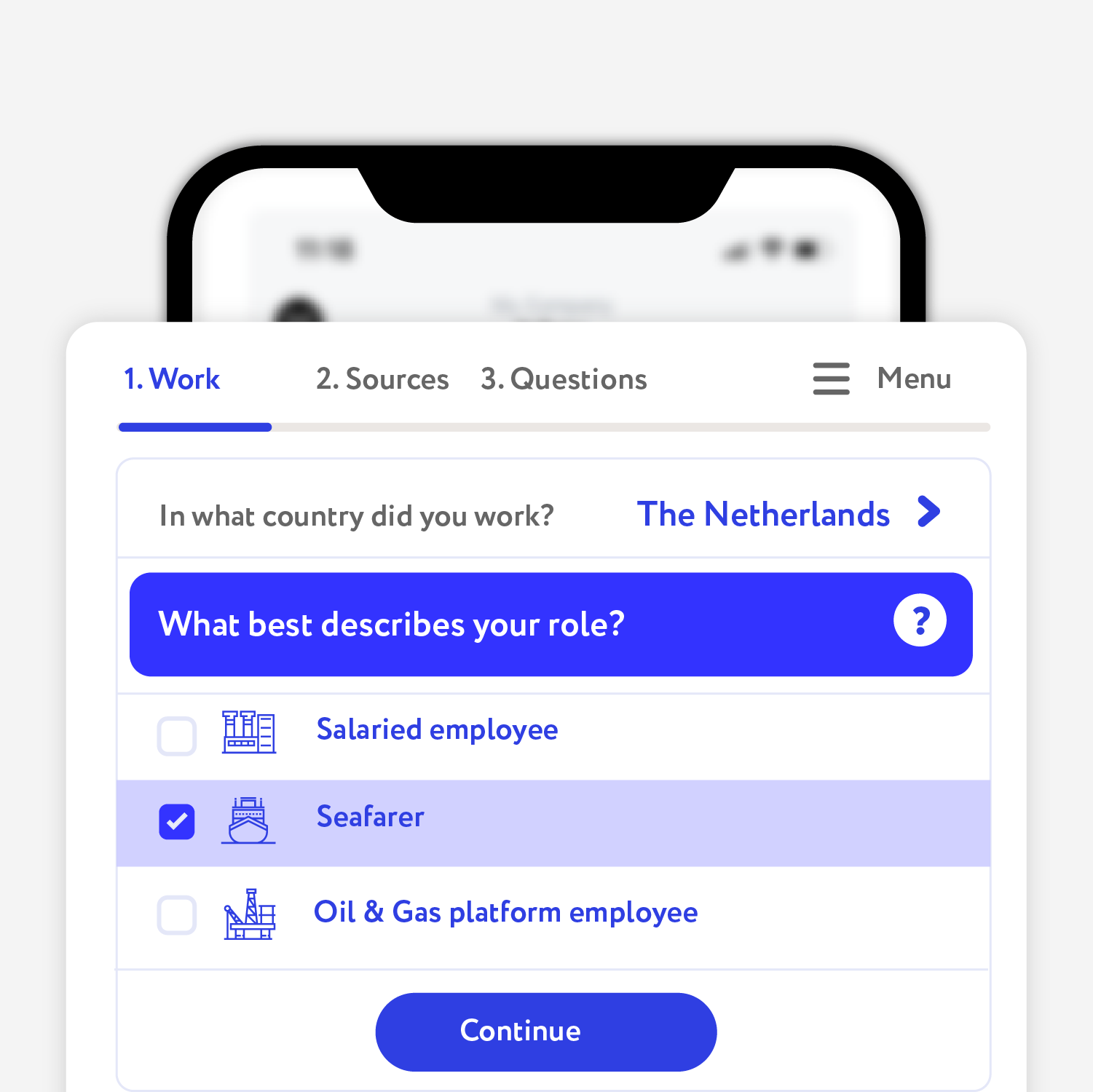

1. Get Started

Let's do this

Our tax agent will answer all your questions. Makes a calculation, completes the tax forms and tax returns, etc.

Our tax agent takes care of your taxes.

Our tax agent takes care of your taxes.

2. That's it.

Well, that's it, you've got your refunds, we've got our %.

You can also get started by using whatsapp, viber or skype.

Just call or text us — we help you to register on our website and answer all your questions.

Just call or text us — we help you to register on our website and answer all your questions.

No risk, you can start without any prepayment.

Pay for the service only if there is a tax refund.

Pay for the service only if there is a tax refund.

Fair price - all depends on

the refund amount.

the refund amount.

Standard

12,5%

Mini

59€

If the refund amount is over 473€, service fee is 12,5% of the amount

If the refund amount is between 0€ to 472€, service fee is only 59€

Service

Tax refunds from the UK

All prices and commissions include VAT

Price

includes:

Free calculation

Tax agent estimates your tax refund and explains the reasons of overpayment.

Tax agent estimates your tax refund and explains the reasons of overpayment.

Free advice

Our tax agent answers all your questions, at the very start.

Our tax agent answers all your questions, at the very start.

Completing tax forms

We prepare, complete and submit your tax forms.

We prepare, complete and submit your tax forms.

Communication with the tax office

We call or write to the tax office - all about your case.

We call or write to the tax office - all about your case.

About UK taxes and forms

Quick facts

Quick facts

All people working in Great Britain have to pay income tax to the state. Furthermore, they have the right to claim tax credits. Some of them are provided automatically. However, in order to get the full amount of tax credits, you just need to initiate the online registration process.

Current income tax rates

The rate of income tax depends on your income. The higher the income, the bigger are taxes. In 2018/2019, the rate of the income tax starts at 20% for income under £34,500 and up to 45% for income over £150,000.

Current tax rates can be found on the official HMRC website

Current income tax rates

The rate of income tax depends on your income. The higher the income, the bigger are taxes. In 2018/2019, the rate of the income tax starts at 20% for income under £34,500 and up to 45% for income over £150,000.

Current tax rates can be found on the official HMRC website

The minimum personal allowance is the part of your income that won't be taxed. In some cases, this tax credit can be provided automatically as a part of your salary.

One is able to claim a refund of the personal allowance:

Taxes and personal allowance in 2018-2019:

Example of the tax refund calculation:

During 2018/19, the income of Victor was equal to £12,000, while the employer took £800 of taxes.

Calculation:

Income (£12,000) - Personal Allowance (£11,851) = Taxed amount (£149) Taxed amount (£149) - Tax (20%) = The correct amount of tax is £29,80

✨💰£770,2

As a result, the income tax paid of Viktor is bigger the right amount, so he's overpaid a tax ✨

Credited tax (£800) - The correct amount of tax (£29,80) = Overpaid amount (£770,2)

One is able to claim a refund of the personal allowance:

- For the last 4 years after the end of the tax year.

- For the current tax year in case you left the UK or stopped working.

Taxes and personal allowance in 2018-2019:

- for the income of less than £11,851 the tax rate is 0% ⟶ due to the personal allowance

- for the income of more than £11,851 and less than £46,350, the tax rate is 20%

- for the income of more than £46,351 and less than £150,000 the tax rate is 40% the tax rate for the income of more than £150,000 is 45%

Example of the tax refund calculation:

During 2018/19, the income of Victor was equal to £12,000, while the employer took £800 of taxes.

Calculation:

Income (£12,000) - Personal Allowance (£11,851) = Taxed amount (£149) Taxed amount (£149) - Tax (20%) = The correct amount of tax is £29,80

✨💰£770,2

As a result, the income tax paid of Viktor is bigger the right amount, so he's overpaid a tax ✨

Credited tax (£800) - The correct amount of tax (£29,80) = Overpaid amount (£770,2)

This is the tax return for your work-related expenses. This tax credit is not provided automatically, and one needs to submit a request to the HMRC.

One can get a tax return in case if they spend more than £60 for work-related expenses to pay for the following:

When it can be requested:

What is the maximum amount of tax deduction:

Example of the tax refund calculation: ✨💰£770,2

During 4 years of work in the agricultural sector, Victor spent £500 of his own money to clean and repair his uniform every year.

Victor is able to get a refund for every year: (£500 - 20%) = £100 x 4 years = £400 ✨ can be returned from the HMRC.

One can get a tax return in case if they spend more than £60 for work-related expenses to pay for the following:

- repairing or replacing small tools required to perform your work (e.g., scissors or a drill),

- cleaning, restoring or replacing the special clothing (e.g., the uniform or boots)

When it can be requested:

- For the last 4 years after the end of the tax year.

- For the current tax year in case if you left the UK or stopped working; or in case if you still work via the tax code. One needs to provide supporting documents in order to prove the indicated amount.

What is the maximum amount of tax deduction:

- the exact amount spent (you have to provide receipts and invoices to the HMRC) the fixed amount (you have to provide receipts and invoices to the HMRC)

- Flat rate expenses allow you to claim tax relief for a standard amount. Depending on the profession and the field of work, the amount of tax refund may vary from £60 to £1022

Example of the tax refund calculation: ✨💰£770,2

During 4 years of work in the agricultural sector, Victor spent £500 of his own money to clean and repair his uniform every year.

Victor is able to get a refund for every year: (£500 - 20%) = £100 x 4 years = £400 ✨ can be returned from the HMRC.

A UK tax year runs from 6 April to the following 5 April. For example, if we are talking about the tax year 2019/20 it would start on 6 April 2019 and finish on 5 April 2020.

💡 The main rule, refund or repayment cannot be claimed more than 4 years after the end of the relevant tax year. So, April 5, 2021, is the last day to apply for tax refunds for tax year 2016/17.

💡 Furthermore, in accordance with the tax legislation, you can claim a tax refund for the current year in only 2 cases:

💡 The main rule, refund or repayment cannot be claimed more than 4 years after the end of the relevant tax year. So, April 5, 2021, is the last day to apply for tax refunds for tax year 2016/17.

💡 Furthermore, in accordance with the tax legislation, you can claim a tax refund for the current year in only 2 cases:

- If you left the UK and have no plans to return during the current tax year.

- If you've been unemployed for at least four weeks

Your employer will provide you with the P45 Form at the end of your employment.

The P45 Form shows the exact amount of taxes taken from your salary from the beginning of the tax year (April 6) until the date of employment termination.

The P45 Form consists of 4 parts: (1A, 2 and 3), and (1)

💡 Useful tip:

The P45 Form shows the exact amount of taxes taken from your salary from the beginning of the tax year (April 6) until the date of employment termination.

The P45 Form consists of 4 parts: (1A, 2 and 3), and (1)

- The (1A, 2 and 3) parts are provided to the employee.

- The (1) part of the P45 form is sent to the HMRC by the employer.

- The employee gives parts (2 and 3) of the P45 Form to new employer or to the tax authorities in order to apply for a tax refund.

- The (1A) part stays with you for future records.

💡 Useful tip:

- In order to get the P45 Form faster, write a dismissal request.

- In case if you lost the P45 Form or you get it, your tax agent will make it on your behalf without any additional fees.

The P60 Form shows the exact amount of taxes cut from your income during the current tax year (from April 6 to April 5). The P60 Form has to be issued by all employers, which paid you salaries. The employer is obliged to issue the P60 Form before May 31 (in paper or electronic format).

💡 You will need the P60 Form to do the following:

💡 Useful tip:

In case if you lost the P60 Form or you get it, your tax agent will make it on your behalf without any additional fees.

💡 You will need the P60 Form to do the following:

- to prove the exact amount of imposed taxes;

- to refund overpaid taxes;

- to apply for tax credits;

- to prove the level of income in case if you need a loan.

💡 Useful tip:

In case if you lost the P60 Form or you get it, your tax agent will make it on your behalf without any additional fees.

Use form P11D if you're an employer and need to report end-of-year expenses and benefits for employees and directors.

- A copy of the P11D Form can be issued by your employer.

- You will get a P11D Form in case if you received various benefits (e.g., a personal car, medical insurance, subsistence allowance, and hospitality expenditures) and your employer reported them to HMRC.

- You won't be able to get a copy of the P11D Form in case if your employer has already taken all the related taxes from provided expenses.

Full tax calculation and the real meaning of Tax Calculation (sometimes called P800).

It's worth noting that Tax Calculation is a letter with tax calculation for a single tax year issued by the tax authorities.

The letter is sent to your home address registered in HMRC at the time of calculation. Furthermore, a copy of the letter will be sent to your agent. On average, the post will deliver it in 2-3 weeks.

The first page of the calculation contains the amount of overpaid taxes (HMRC owes you) and unpaid taxes (You owe HMRC).

The second page of the calculation contains information about all types of income including salaries, pensions, personal assets and interests, paid taxes, personal allowance, other tax credits and the final result of the calculation.

When you will receive the P800

It will be automatically issued in case you have overpaid or underpaid taxes. The P800 letter is sent by the end of November, after the end of the tax year on April 5. One is able to submit a request to HMRC in order to get a calculation. You can receive the calculation throughout the year.

By the way, HMRC won't be able to issue a copy of the calculation in case they sent you the P800 letter, while you didn't receive it. In this case, you can only apply for a short version of the calculation.

P800 says that you have a refund

In case if the P800 letter says that you got a tax refund, you can get it online by providing a number of a bank account in the UK. The money will be credited in 5 working days. In case if you don't do anything, HMRC will send you a cheque in 45 days.

In case if the P800 says that you will receive a cheque, it will arrive in 14 days after the date of the P800 issuance.

In case if you had overpaid taxes in previous years, you will get a single cheque for the entire amount. If you have an agent, there are high chances that they will receive it.

💡 Useful tip:

It's worth noting that Tax Calculation is a letter with tax calculation for a single tax year issued by the tax authorities.

The letter is sent to your home address registered in HMRC at the time of calculation. Furthermore, a copy of the letter will be sent to your agent. On average, the post will deliver it in 2-3 weeks.

The first page of the calculation contains the amount of overpaid taxes (HMRC owes you) and unpaid taxes (You owe HMRC).

The second page of the calculation contains information about all types of income including salaries, pensions, personal assets and interests, paid taxes, personal allowance, other tax credits and the final result of the calculation.

When you will receive the P800

It will be automatically issued in case you have overpaid or underpaid taxes. The P800 letter is sent by the end of November, after the end of the tax year on April 5. One is able to submit a request to HMRC in order to get a calculation. You can receive the calculation throughout the year.

By the way, HMRC won't be able to issue a copy of the calculation in case they sent you the P800 letter, while you didn't receive it. In this case, you can only apply for a short version of the calculation.

P800 says that you have a refund

In case if the P800 letter says that you got a tax refund, you can get it online by providing a number of a bank account in the UK. The money will be credited in 5 working days. In case if you don't do anything, HMRC will send you a cheque in 45 days.

In case if the P800 says that you will receive a cheque, it will arrive in 14 days after the date of the P800 issuance.

In case if you had overpaid taxes in previous years, you will get a single cheque for the entire amount. If you have an agent, there are high chances that they will receive it.

💡 Useful tip:

- In case if you are sure that the Tax Calculation contains the wrong amount, you need to contact the HMRC or one of our agents.

- In case if you haven't received the Tax Calculation you need to contact the HMRC or one of our agents.

National Insurance number (NIN)

The NIN consists of letters and digits and remains the same for the person.

NN 12 34 56 A

Any person of at least 16 years and working in the UK is obliged to receive this number in order to work within the country. The number can be used to request medical services, open a bank account or even rent an apartment.

One can find their NIN in the following places:

The NIN consists of letters and digits and remains the same for the person.

NN 12 34 56 A

Any person of at least 16 years and working in the UK is obliged to receive this number in order to work within the country. The number can be used to request medical services, open a bank account or even rent an apartment.

One can find their NIN in the following places:

- in the pay sheet

in the P60 and P45 forms

in the letter from the HMRC tax authority

- Visit the nearest Job Centre as soon as you come to the country in order to apply for the number. Kindly note that the issuance of the number takes 2-6 weeks.

- In case if you lost your NIN, you can submit the CA5403 form or call the NI helpline: 0300 200 3500. The HMRC will send you a letter with the NIN in 10 working days.

Foreign Self-employed construction workers in the UK get their salary after the deduction of the CIS tax by the contractor (the rate is 20%) as part of the Construction Industry Scheme (CIS). After that, the contractor sends the amount of tax to the HMRC.

That's an average tax rebate around of £1000 ✨💰

By submitting the tax return, one is able to refund the amount of taxes for the personal allowance, as well as the money spent on equipment, uniform, food and travel services. Don't miss it!

Pay upfront or pay after you get a refund

You can choose a method of payment for our service.

1) You will pay only 119€, if you choose an upfront payment option.

2) We'll just take 219€ after your you receive your tax refunds.

Start your CIS tax return

That's an average tax rebate around of £1000 ✨💰

By submitting the tax return, one is able to refund the amount of taxes for the personal allowance, as well as the money spent on equipment, uniform, food and travel services. Don't miss it!

Pay upfront or pay after you get a refund

You can choose a method of payment for our service.

1) You will pay only 119€, if you choose an upfront payment option.

2) We'll just take 219€ after your you receive your tax refunds.

Start your CIS tax return

Thank You for your work . I couldn't have done it on my own. Good luck with your work. Thanks!

28.04.2018

Nagim

A great team, a team of professionals, I will definitely advise and tell my friends and colleagues about you.

17.02.2018

Ruslan

View all reviews

New feedback about EUtaxback

Taxes from: United Kingdom

Taxes from: United Kingdom

Better if to start with friends

Register together with friend - everyone gets a 10% discount on service fees. Simply indicate a discount code Friends10 and your friend's surname, and your friend indicates your surname.